21+ 2020 Capital Loss Carryover Worksheet

NW IR-6526 Washington DC 20224. Get your tax refund up.

Solved Problem 4 3 What Is A Capital Asset Holding Period Chegg Com

The amount of tax-exempt income from forgiveness of the PPP Loan that you are treating as received or accrued and for what taxable year 2020 or 2021.

. Line 1 and Line 5. 18 section 251065-2 and FTB Pub. Net short-term capital gain loss and net long-term capital gain loss from Schedule D Form 1065 that isnt portfolio income.

The underbanked represented 14 of US. An activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit and you are involved in the activity with continuity and regularity. An example is gain or loss from the disposition of nondepreciable personal property used in a trade or business activity of the partnership.

If Schedule A is. 2021-48 and for what taxable year 2020 or 2021 as applicable. See the Instructions for Form 1040 and complete the Foreign Earned Income Tax Worksheet to figure the amount of tax to enter on Form 1040 or 1040-SR line 16.

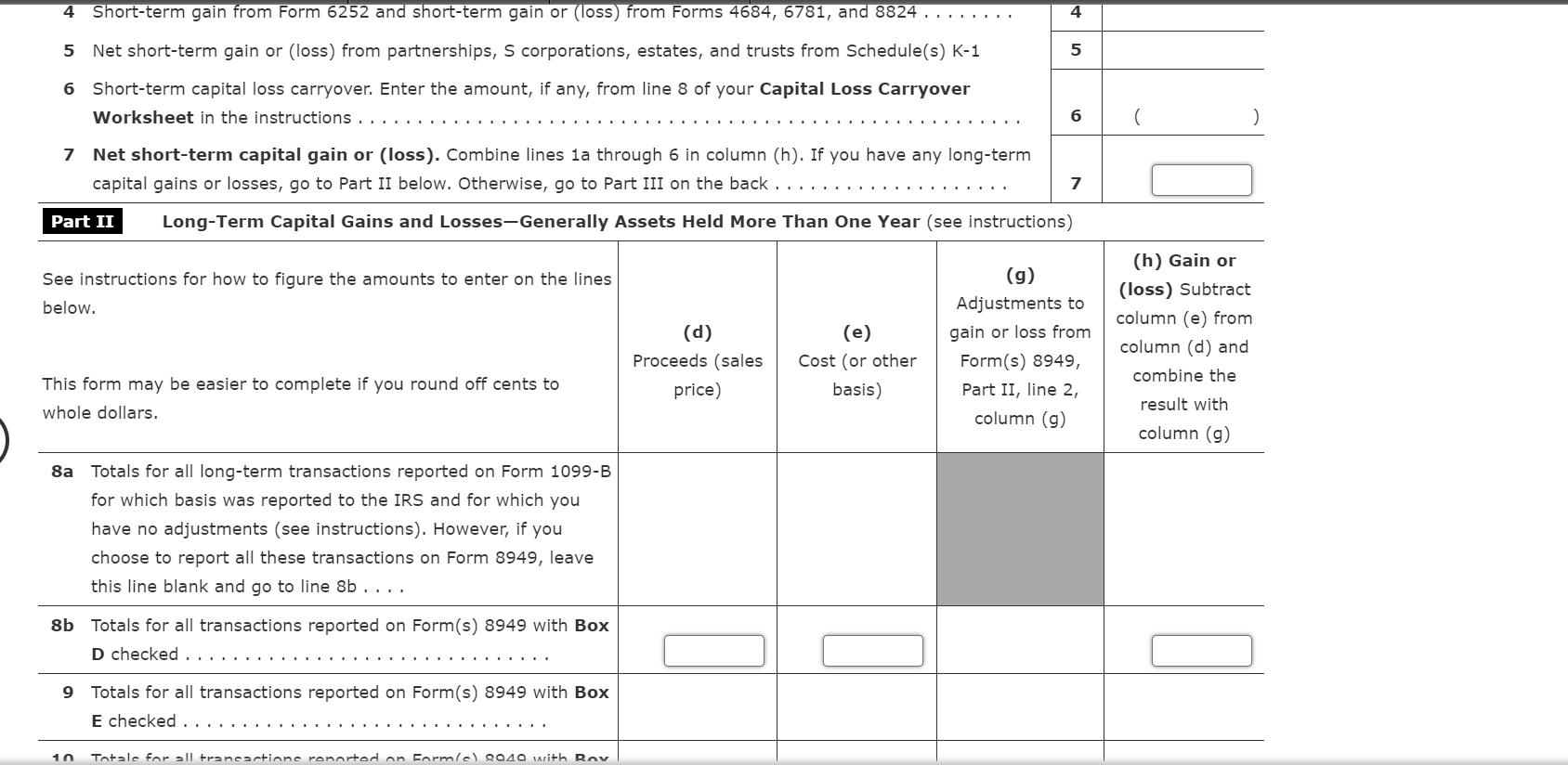

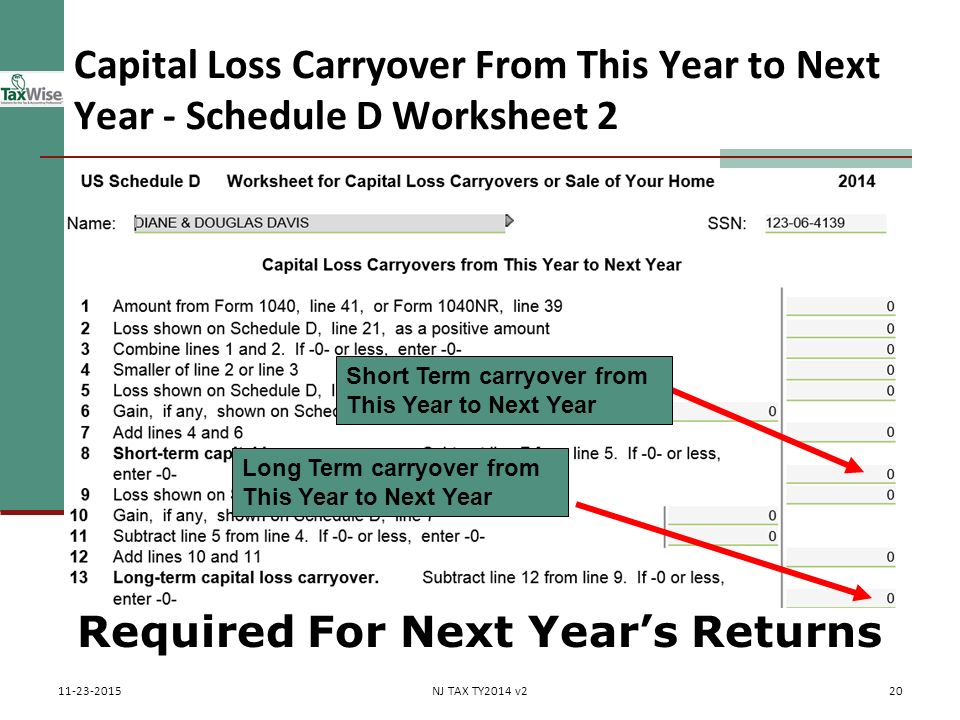

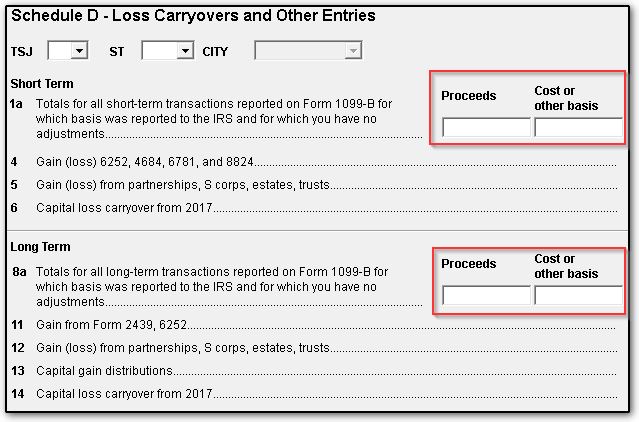

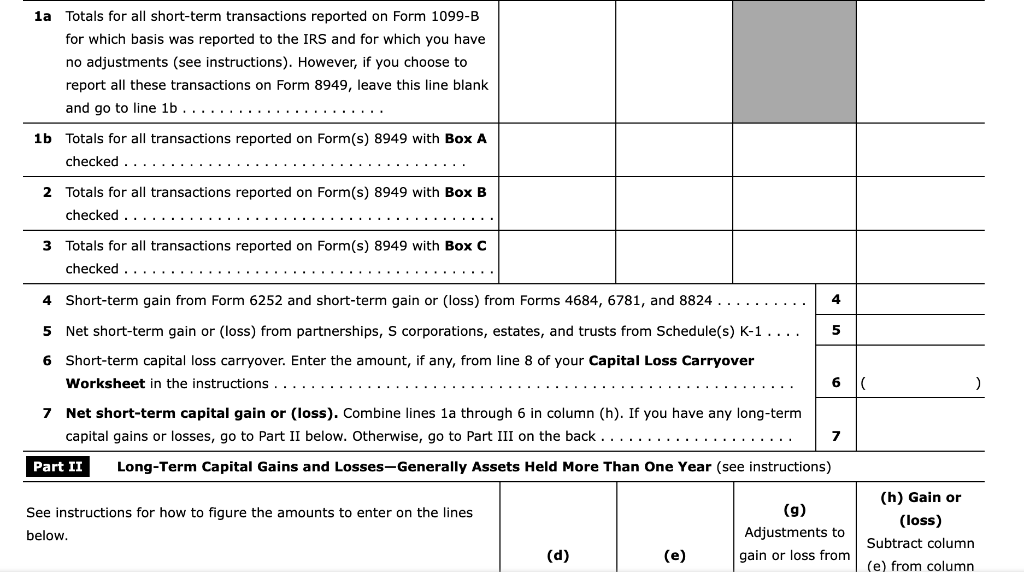

If there is a loss on your 2020 Schedule D line 21 add that loss as a positive amount and your 2020 capital loss carryover to 2021. For individual non-business returns for the past two tax years 2021 2020. Use this worksheet to figure your capital loss carryovers from 2021 to 2022 if your 2021 Schedule D line 21 is a loss and a that loss is a smaller loss than the loss on your 2021 Schedule D line 16.

It is the mechanism for recovering your cost in an income-producing property and must be taken over the expected life of the property. For information regarding the application of the capital loss limitation and the capital loss carryover in a combined report see Cal. For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000.

If you use the proceeds of a loan for more. 2020 through March 31 2021 you may be entitled to claim the credit for family leave if you were unable to perform services as a self-employed individual because of certain. Complete the State and Local General Sales Tax Deduction Worksheet or use the Sales Tax Deduction Calculator at IRS.

For example if you sold a stock for a 10000 profit this year and sold another at a 4000 loss youll be taxed on capital gains of 6000. His tax attributes included the basis of depreciable property an NOL and a capital loss carryover to 2021. 116-94 added section 45T.

Depreciation is a capital expense. In column b enter the expenses that benefit the entire home indirect expenses. For 2020 the standard mileage rate for business use is 575 cents a mile.

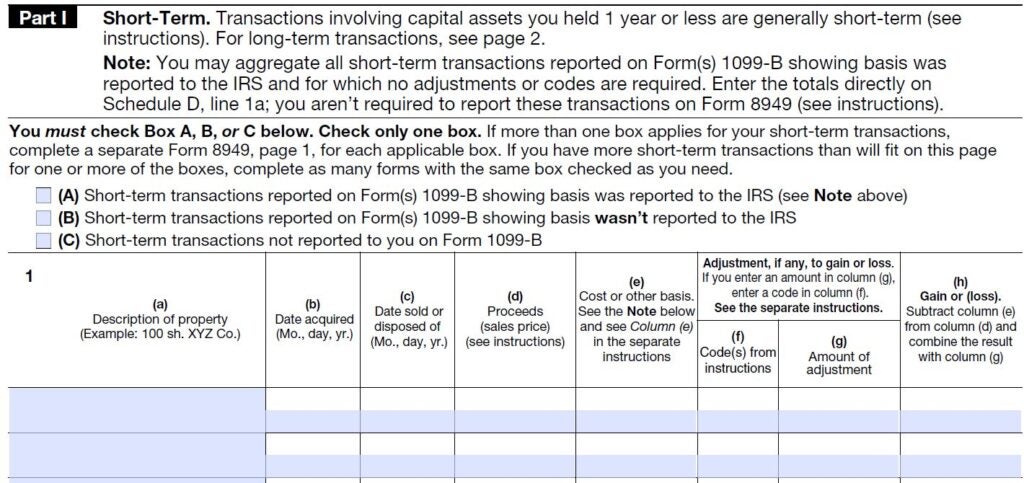

Extension and expansion of credits for sick and family leave. A worksheet to reconcile amounts reported in the decedents name on information returns including Forms W-2 Wage and Tax Statement. Report total net short-term gain loss on Schedule D Form 1040 line 5.

If you deducted actual expenses for the business use of your home on your 2020 tax return enter on line 23 the amount from line 41 of your 2020 worksheet. Curts business encountered financial difficulties in 2021. It includes income from licensing the use of property other than goodwill.

But it doesnt include capital gains. We welcome your comments about this publication and suggestions for future editions. Schedule D Form 1040 Capital Gains and.

The IRS issues more than 9 out of 10 refunds in less than 21 days. A statement that you are applying or applied section 3011 2 or 3 of Rev. Net Operating Loss Suspension For taxable years beginning on or after January 1 2020 and before January 1 2023 California has suspended the net operating loss NOL carryover deduction.

This guarantee does not apply to TurboTax Business desktop software. To do this use the Rate Table for Self-Employed or the Rate Worksheet for Self-Employed whichever is appropriate for your plans. For more information see IRSgovCOVID-19-Related-Tax-Credits.

1099-DIV Dividends and Distributions. Taxable income is modified to exclude net operating loss and capital loss carrybacks or carryovers. References in these instructions are to the Internal Revenue Code IRC as of January 1 2015 and to the California Revenue and Taxation Code RTC.

Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor. Her personal representative must file her 2020 return by April. On Schedule 1 Form 1040 line 21 as explained in Pub.

The COVID-related Tax Relief Act of 2020 extended the period during which self-employed individuals can claim these credits from April 1 2020 through March 31 2021. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2620000Also the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning in 2021. You would report the following on your California Adjustment Worksheet Schedule E Activities FTB 3801 Side 2.

Net Operating Loss Suspension For taxable years beginning on or after January 1 2020 and before January 1 2023 California has suspended the net operating loss NOL carryover deduction. References in these instructions are to the Internal Revenue Code IRC as of January 1 2015 and the California Revenue and Taxation Code RTC. Large corporations figure the amount to enter on line 11 as follows.

If you had an NOL for 2020 enter it as a positive amount. See the Instructions for. A weight-loss program as treatment for a specific disease including obesity diagnosed by a doctor.

Schedule C Form 1040 Profit or Loss from Business. Section 179 deduction dollar limits. Or b if the amount on your 2021 Form 1040 or 1040-SR line 15 or your 2021 Form 1040-NR line 15 if applicable would be less than zero.

Actual expenses or the standard mileage rate. In general the NOL deduction for tax years beginning after December 31 2020 cannot exceed the sum of the NOLs carried to the year from tax years beginning before January 1 2018 plus the lesser of i the NOLs carried to the year from tax years beginning after December 31 2017 or ii 80 of the excess if any of taxable income computed without. The 5th Circuit Court of Appeals ruling sets up a major legal battle and could create uncertainty for fintechs.

On September 21 2021 the bank financing the retail store loan entered into a workout agreement with him under which it canceled 20000 of the principal amount of the debt. You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. Figure the corporations 2021 tax in the same way that line 8 of this worksheet was figured using the taxes and credits from the 2021 income tax return.

Multiply line 21 column b by the business-use percentage line 3 and enter this amount on line 22. The Further Consolidated Appropriations Act 2020 PL. Those who have a checking or savings account but also use financial alternatives like check cashing services are considered underbanked.

For more information see chapter 4 of Pub. Samantha Smith died on March 21 2021 before filing her 2020 tax return. Subtract from that sum the amount of the loss on your 2020 Schedule D line 16 and enter the result.

The difference between the California loss of 5000 and the federal loss of 3500 would be included in the California adjustment on Schedule D 540 or 540NR California Capital Gain or Loss Adjustment or California Schedule D-1. Enter any unused capital loss carryover from 2019 Form 100 Side 6 Schedule D line 11 on 2020 Form 100 Side 6 Schedule D line 3.

2022 Schedule D Form And Instructions Form 1040

Sch D Capital Gain Form 1040 Tax Return Preparation Youtube

Capital Gains Losses Including Sale Of Home Ppt Download

Schedule D Lines 1a And 8a Scheduled

Problem 18 47 Lo 6 Sam Upchurch A Single Chegg Com

Capital Loss With Little Or No Income Fairmark Com

Schedule D 541 California Franchise Tax Board

Schedule D How To Report Your Capital Gains Or Losses To The Irs Bankrate

Capital Loss Carryover Fill Out Sign Online Dochub

Where To Find California Capital Loss Carryover From A Prior Year

Capital Loss Carryover Worksheet Fill Out Sign Online Dochub

Capital Loss Does Not Match T2 Auto Fill Value T2 Protaxcommunity Com

Capital Loss Carryover Fill Out Sign Online Dochub

2021 Capital Loss Carryover Worksheet Fill Online Printable Fillable Blank Pdffiller

Form 1041 Schedule D Capital Gains And Losses

Solved Why Didn T Turbotax Import My Capital Loss Carryover

Irs 1040 Schedule D Instructions 2020 2022 Fill Out Tax Template Online